Presented by Bruce Hosler

Financial Market Quarterly Highlights, Q4 2020

- Domestic and international markets finished the month, quarter, and year with positive results.

- The start of the public vaccination process was a positive development for the coronavirus crisis.

- Economic data was mixed heading into year-end, but the stimulus bill and public health progress should help support growth moving forward.

Strong December Caps Off Solid Year

Markets continued to rally in December. The Nasdaq Composite led the way with a 5.71 percent gain for the month. The S&P 500 gained 3.84 percent, and the Dow Jones Industrial Average (DJIA) rose by 3.41 percent. These results contributed to a strong quarter for markets, with the Nasdaq up 15.63 percent, the S&P 500 up 12.15 percent, and the DJIA up 10.73 percent. For the year, DJIA gained 9.72 percent, the S&P 500 returned 18.40 percent, and the Nasdaq surged 44.92 percent.

These strong results coincided with improving fundamentals. According to Bloomberg Intelligence, as of December 24, the blended third-quarter earnings decline for the S&P 500 was 6.9 percent, much better than the initial forecast for a 21.5 percent decline.

Technical factors were also supportive. All three major indices remained above their 200-day moving averages for the sixth consecutive month, indicating technical support for markets through the second half of the year.

International markets also finished the year strong. The MSCI EAFE Index gained 4.65 percent in December, which contributed to a 16.05 percent increase for the quarter and a 7.82 percent annual gain. The MSCI Emerging Markets Index gained 7.40 percent for the month, 19.77 percent for the quarter, and 18.69 percent for the year. Technicals were supportive for international markets at year-end, with both indices finishing December above their 200-day moving averages.

Fixed income markets also ended the year with positive results. The Bloomberg Barclays U.S. Aggregate Bond Index gained 0.14 percent in December, 0.67 percent for the quarter, and an impressive 7.51 percent for the year.

High-yield fixed income returned 1.88 percent during the month, 6.45 percent for the quarter, and 7.11 percent for the year. High-yield credit spreads finished the year at 3.87 percent.

Signs Of Pandemic Progress

We saw signs of progress on the public health front during the month. New cases per day showed improvement at month-end, although it’s likely the holidays contributed to a lull in reporting. If case growth is in fact slowing, we could see a peak in the next few weeks.

Testing also showed some improvement, although a slowdown in testing around the holidays led to the positive test rate increasing modestly at month-end. The positive test rate finished the month below the recent highs we’ve seen during the third wave, which is a good sign.

Another positive development was the start of the public vaccination process. The number of vaccinations was relatively low at year-end, but the pace should pick up as state and local governments build out the necessary infrastructure.

Economic Headwinds Remain

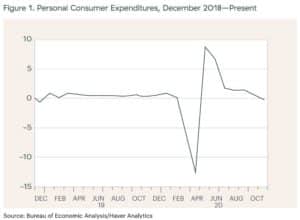

The third wave still presents risks to the economic recovery. Retail sales and personal spending fell in November, highlighting the headwinds created by increased shutdown measures. As you can see in the chart, this was the first drop for personal spending since initial lockdowns were lifted in April. There is hope that the second stimulus bill and continued public health progress will spur spending growth.

Business confidence and spending held up well despite rising case counts. Both manufacturer and service sector confidence remain near or above pre-pandemic levels. These strong confidence figures have translated into faster spending and output growth.

Risks Moderate To Start 2021

December’s updates highlighted the risks presented by rising case counts and increased local restrictions. But the resilient economy, combined with expected tailwinds from additional stimulus and further public health progress, indicates we are in a relatively good place to start the year. Given the short-term uncertainty, a well-diversified portfolio that matches investor goals and timelines remains the best path forward for most. If concerns remain, contact your financial advisor to review your financial plan.

Information according to Bloomberg, unless stated otherwise.

RELATED CONTENT & PODCASTS:

Please see important disclosures.

Disclosures

Market Commentary Disclosure

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities.

Securities and advisory services offered through Commonwealth Financial Network®, Member www.FINRA.org/www.SIPC.org, a Registered Investment Adviser. Hosler Wealth Management is located at 700 S. Montezuma St., Prescott, AZ 86303 and can be reached at 928-218-3619. Tax preparation and accounting service offered by Hosler Wealth Management, LLC are separate and unrelated to Commonwealth. This communication is strictly intended for individuals residing in the states of AK, AZ, CA, CO, FL, GA, ID, IL, ME, NM, NV, OH, TX, UT, VA, WA, WI. No offers may be made or accepted from any resident outside these states due to various state requirements and registration requirements regarding investment products and services. Review our Terms of Use: https://www.commonwealth.com/termsofuse.html

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, and Sam Millette, senior investment research analyst, at Commonwealth Financial Network®.

© 2021 Commonwealth Financial Network®